Mergers & Acquisitions

Using state-of-the-art merger analytics, we have evaluated the competitive effects of mergers and acquisitions in many high-profile matters involving airlines, health care, pharmaceuticals, telecommunications, media, supermarkets, and chemicals. Our experts have worked on behalf of clients in front of competition authorities and have also provided economic analyses for agencies including the US Department of Justice, the Federal Trade Commission, and the Federal Communications Commission, as well as the Canadian Competition Authority and other international authorities. We have helped evaluate transactions before various competition authorities in the United States, Canada, Mexico, Latin America, Europe, and Australia.

Our Capabilities

Our affiliated and internal experts have undertaken analyses of mergers and acquisitions to assess many factors, including:

- Market definition

- Market power

- Unilateral and coordinated effects

- Efficiencies

- Pass-through of efficiencies

- Barriers to entry

As needed, we have relied on a range of analytical techniques, including event studies, bid analysis, critical loss analysis, upward pricing pressure analytics, and merger simulation.

With our global network of competition specialists, we are able to offer clients a full spectrum of support for transborder and transatlantic competition matters.

-

Case OutcomeUS et al. v. Anthem Inc. et al.

Case OutcomeUS et al. v. Anthem Inc. et al. -

Featured Expert David Dranove

Featured Expert David Dranove -

Publishing United States: Platform Economics and Mergers

Publishing United States: Platform Economics and Mergers -

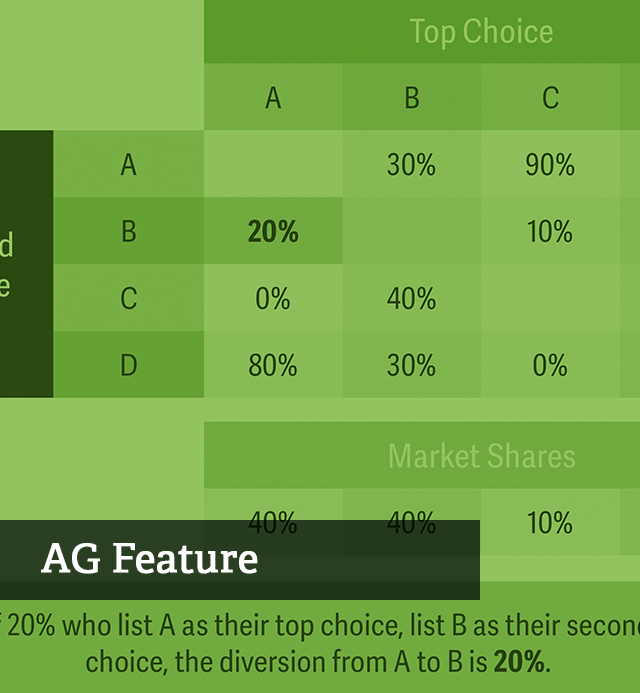

AG Feature The “Tyranny of Market Shares”: Incorporating Survey-Based Evidence into Merger Analysis

AG Feature The “Tyranny of Market Shares”: Incorporating Survey-Based Evidence into Merger Analysis -

Case Outcome AT&T Acquisition of DIRECTV – Survey of Consumer Preferences

Case Outcome AT&T Acquisition of DIRECTV – Survey of Consumer Preferences -

Featured Expert James Levinsohn

Featured Expert James Levinsohn