-

The Ongoing Evolution of Cryptocurrency Regulation and Litigation

Regulatory agencies’ approaches to cryptocurrencies will have a key impact on how these cutting-edge technologies will evolve, and the litigation that they will inevitably generate.

In recent months, regulatory bodies have begun to stake out positions on their jurisdiction over cryptocurrencies. Many of the questions turn on how to define and classify cryptocurrencies and cryptocurrency-related technologies or products.

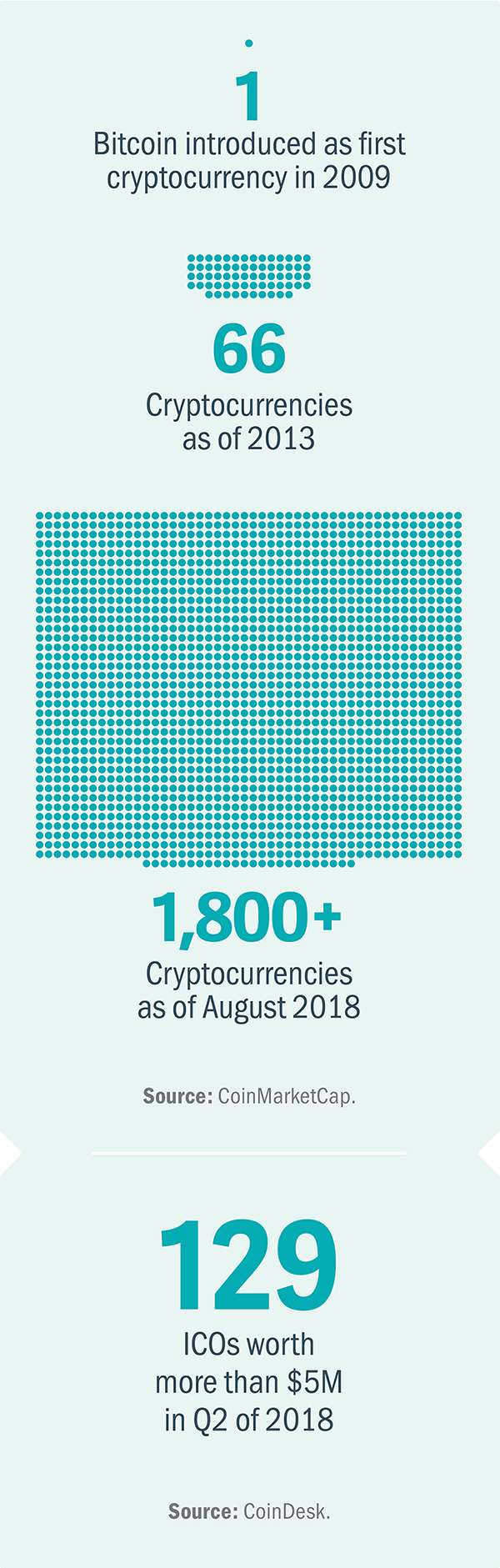

“Cryptocurrency” is a generic term for a virtual currency based on cryptography, of which Bitcoin is the most well-known. Unlike government-backed “fiat” currencies, no central bank controls the supply of a cryptocurrency or provides a backstop. Instead, a cryptocurrency is generally established and becomes available via “mining,” the process by which market participants verify valid transactions using a set of sophisticated algorithms and protocols. The soaring value of many cryptocurrencies in 2017 brought increased attention to the market, which in turn led to the creation of new cryptocurrencies – even as some commentators noted the extreme volatility in cryptocurrency markets and compared the situation to a financial bubble.

The surge in interest in cryptocurrencies has spurred corresponding growth in initial coin offerings (ICOs), a mechanism for raising funding for cryptocurrency-related ventures. ICOs themselves have begun to attract increasing attention from regulators. In particular, the US Securities and Exchange Commission (SEC) has argued that ICOs are subject to its existing regulatory authority over securities offerings.

In 2017, the SEC shut down an attempted ICO by the cryptocurrency startup Munchee, claiming that it constituted a securities offering that Munchee had failed to register. In addition, one of the first ICO-related class actions was filed in November 2017, relating to the cryptocurrency known as Tezzies. The proposed class action includes allegations of false advertising, securities fraud, unfair competition, and failing to register the offer and sale of securities.

At the same time, the Commodity Futures Trading Commission (CFTC) has started to regulate certain types of cryptocurrencies as commodities, raising questions as to whether cryptocurrencies will be treated differently for regulatory purposes at different points during their life cycle. Tax authorities are also taking different approaches to cryptocurrencies. In the US, the Internal Revenue Service (IRS) treats cryptocurrencies as property, with the result that any cryptocurrency transaction may trigger capital gains tax. In contrast, a 2015 European Court of Justice ruling found that Bitcoin should be treated as a currency, and therefore not be subject to value-added taxation as a product.

Another key focus is the security of the coin exchanges on which cryptocurrencies typically are traded. Several exchanges purportedly have been the subject of cyberattacks; these reports may prompt increased government scrutiny, as was the case in the aftermath of the admitted hack of the Coincheck exchange in Japan. If cryptocurrency holders suffer losses in these attacks, they may also attempt to file class action litigation.

To date, regulators have focused on potential fraud and market manipulation in cryptocurrency trading, but the market’s rapid evolution is likely to continue to raise new legal and regulatory questions. ■

Steven Saeger, Vice President

Mark Berberian, Manager

Rozi Kepes, Associate